Treasury Bills 101

Meow Technologies is a financial technology company, not a bank.

Advisory services are offered through Meow Advisory, LLC, an SEC-registered investment advisor. Brokerage services provided by BNY Mellon Pershing, member SIPC, through a clearing and custody relationship with Atomic Invest.

Wait, what are Treasury Bills? And how do they stack up to our other options?

So we wrote a super simple 5-part guide:

- What is a Treasury Bill?

- How you Earn Interest with T-Bills

- T-Bill Lot Sizes

- T-Bills vs. Money Market Funds vs. Certificates of Deposit

- Why Startups Buy T-Bills

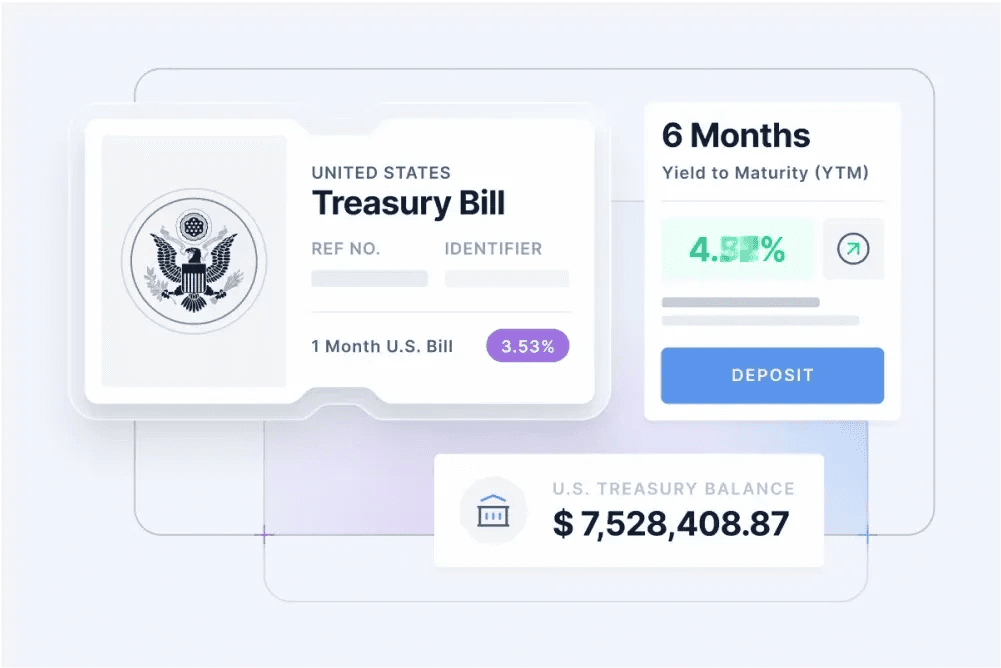

1. What is a Treasury Bill?

A Treasury Bill, also known as a T-Bill, is short-term debt issued by the U.S. government to finance its operations.

T-Bills are typically issued with maturities of 4 weeks, 8 weeks, 13 weeks, 26 weeks, or 52 weeks.

When you buy a T-Bill, you're essentially lending money to the government and in return, you receive interest on your investment.

2. How You Earn Interest With T-Bills

The U.S. government pays you interest when the T-Bill matures. Until the maturity date, you are accruing value but you don’t actually earn your fixed amount of interest until maturity.

For example, let's say you purchase $10 million of T-Bills with a 1-year maturity and an interest rate of 5.0%.

When the T-Bill matures, the government will pay you back the full $10 million plus $500,000 in interest.

You earn this interest regardless of changes in interest rates between purchase and maturity.

When a Treasury bill is issued, it is sold at a price lower than its face value, which is known as a discount. This discount represents the interest that the investor will earn on the Treasury bill.

If a 1-year T-Bill has a face value of $10 million and an approximate interest rate of ~5%, it will be sold at a discount of $9,500,000. At the end of the year, the investor will receive the full face value of the T-Bill, which is $10 million. The difference between the purchase price of $9,500,000 and the face value of $10 million represents the interest earned by the investor, which in this case is $500,000.

The discount to face value is essentially a way for the government to pay the interest at the end, rather than in periodic payments.

3. T-Bill Lot Sizes

T-Bills are typically sold in denominations of $1,000 but this can vary depending on your provider. Tactically, this means that if you buy $1 million of T-Bills, you’re essentially buying 1,000 lots of $1,000 increments.

4. Treasury Bills vs. Money Market Funds vs. Certificates of Deposit

Money Market Funds

Money Market Funds are mutual funds that invest in short-term securities such as T-Bills, commercial paper, and certificates of deposit. However, money market funds are not backed by the U.S. government and sometimes hold non-government securities such as commercial paper.

Commercial paper means you are buying the debt of other businesses which is riskier than the U.S. Government.

Certificates of Deposit (CDs)

CDs are similar to T-Bills in that they are also short-term debt instruments with fixed interest rates. However, CDs are issued by banks, not the government. CDs are less liquid than T-Bills and may carry more risk.

5. Why Startups Buy Treasury Bills

- Safety: Treasury Bills are backed by the full faith and credit of the U.S. government, making them one of the safest investments available. For a company burning cash, preserving capital is a top priority and Treasury Bills are a way to do so.

- Liquidity: Treasury Bills are highly liquid, meaning they can be easily bought and sold. This can be important for a company burning cash that may need to access their funds quickly in the event of an emergency or unexpected expense.

- Flexibility: Unlike other investments, such as corporate bonds, Treasury Bills can be purchased in small denominations and with a range of maturities, from a few weeks to several years. This can allow a company burning cash to tailor their investment strategy to their specific needs and cash flow requirements.

- Yield: While Treasury Bills typically offer lower yields than corporate bonds, they can still provide a higher yield than cash or money market funds. This can be attractive to a company burning cash that is looking for a relatively safe way to earn some return on their investment.

- Cut Out the Middleman: With Treasury Bills compared to money market funds, you cut out the middleman. When you invest in a money market fund, you are buying shares in a mutual fund which means there is an additional layer of fees involved, which can reduce overall return. On the other hand, when you invest directly in Treasury Bills, you are buying the securities themselves which can help you maximize your return and keep more of your cash in your pocket.